As the world transitions to a digital economy, e-commerce is expanding exponentially. Additionally, brick-and-mortar establishments are going online and becoming globalized. This change means that payments have to be made online to vendors by international clients. Therefore, you need reliable international gateways to make the payment process seamless and secure. This is crucial to gaining customers’ trust and decreasing payment failure rates. In this article, we discuss the top international payment gateways that merchants can easily set up and use without any difficulty.

How To Receive International Payments?

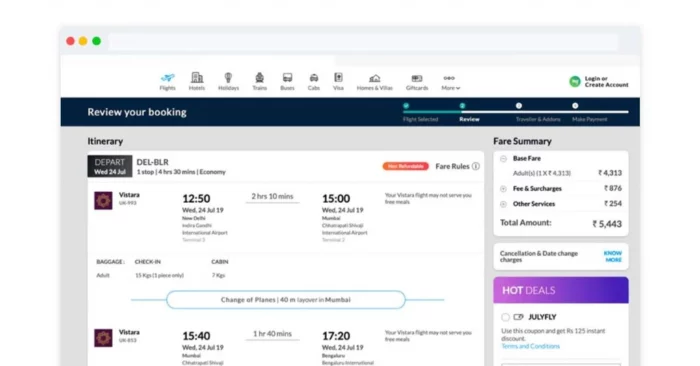

If you want a rapid transmission of international payments from clients abroad to the account in exchange for services or goods, you must opt for an international payment gateway solution. A payment gateway for international payments transmits your consumer’s information from your online portal to the associated bank or card network for processing. The transaction details are returned to the portal to notify customers whether the payment is complete with effective authorization. If the authorization is successful, money is transmitted from the client’s account to the merchant’s (seller) account. Well, for this, international payment gateways seek registration with institutions and payment networks in various countries. You need to pay at least a transaction fee to get services delivered by an international payment gateway like PayPal.

What’s International Payment Gateway?

International payment gateway is a tool businesses integrate into their platform for making & receiving payments from anywhere worldwide. An international gateway allows multi-currency payments and interfaces with various regional languages worldwide so that transactions occur smoothly. The transaction can occur vide direct bank transfers, debit cards, credit cards, etc. Payment gateways combine merchant account capabilities and international payment processors for authorizing transactions. The payment information is sent from the merchant’s page to the bank’s server or payment network, and the response (success or failure) is conveyed back to the page.

Why Need International Payment Gateways?

It necessitates access to a payment gateway for international payments. International payment gateways are critical because of the following reasons.

Different Countries Have Different Currencies

Consumers are more likely to convert when they see service and/or product prices listed in their currency. Unfortunately, there’s no standard currency worldwide, and the currency conversion rates vary. In addition, foreign customers can always convert INR prices into their standard currency, which makes benchmarking prices problematic. So, if you wish to have a large base of customers, you must have an international payment gateway that enables clients to pay in their local currency.

Saves Time & Streamlines Processes

The Global payment gateway solutions simplify payments by supporting various worldwide payment modes. They have UI elements that can be easily customized to create custom payment forms. So that information can be sent straight to international payment processors. International payment gateways also facilitate rapid transfers and settlements, sharing of payment links, etc.

Decrease Failure Rates

In addition to being multi-currency payment gateways, international gateway solutions have capabilities like automatic payment retries to decrease the chances of payment failures. They guarantee that customers do not have to enter all the details every time for recurring payments. An international payment gateway such as PayPal ensures the information is stored securely.

Ensures Safety During Transactions

Monetary transactions contain high risk and require high security to prevent any deception. By using reliable global payment gateway solutions, merchants can collect and send payments effortlessly. In addition, payment gateways verify client identity and provide functionalities for tax calculations.

How To Select The Right International Payment Gateway?

Bear in mind the following factors while selecting the international payment gateway to make the correct choice.

Budget – Based on the scale of your business, the amount that requires to be processed by the payment gateway annually fluctuates. International gateway payment vendors have distinct establishment fees, processing charges, and annual maintenance fees. Choose the one that suits your business and offers flexible pricing models.

User-friendliness – The gateway solution has to be simple to use and integrate with other systems, such as CRM and invoice software. The solution has to provide features like custom payment forms, branding, payment processing, etc. It must support mobile payments to increase consumer conversion rates.

Country-wise Support – It must verify the support for INR and other currencies depending on its target audience. Well, multi-currency payment gateways that support many languages are excellent for attracting customers. Confirm that you check the terms and conditions to avoid confusion later.

Payment Modes – There must be multiple international gateway payment modes, including debit cards, credit cards, net banking, and EMI, among other modern options. This allows merchants to ensure that one-time and subscription-based recurring payments occur effortlessly.

Security & Compliance – While you wish to make payments simple and fast for customers, it should not come by compromising security. Financial transactions demand sensitive customer information, so your payment gateway must have tools to ensure security. There are distinct PCI (Payment Card Industry) compliance standards dependent on the choice of country. If a gateway is PCI compliant, it complies with international security standards.

Best 10 International Payment Gateways

Here’s a collection of international payment gateways frequently used by businesses across industries to close transactions globally.

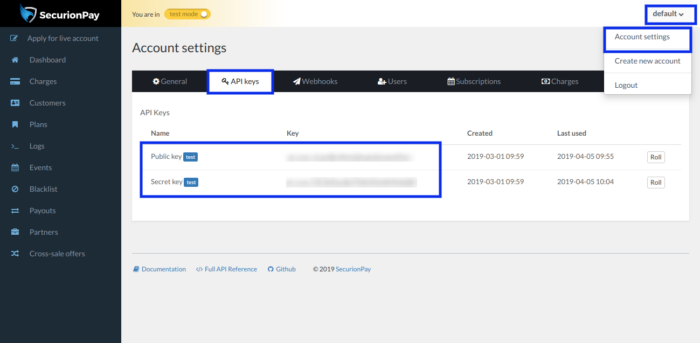

1. SecurionPay

SecurionPay allows businesses to accept web and mobile payments in 160 different currencies securely. The platform supports blended payment models, providing customers with single and automatic recurring payment options. In addition, set up intervals for payment retries to decrease conversion failure rates.

Features

- Support for 24 languages.

- One-click payments.

- Zapier integration.

- PCI Level 1 & Tokenization for credit cards.

- Anti-fraud tools & blacklisting.

- Does not support business models such as eCigarettes, ISP & hosting services, etc.

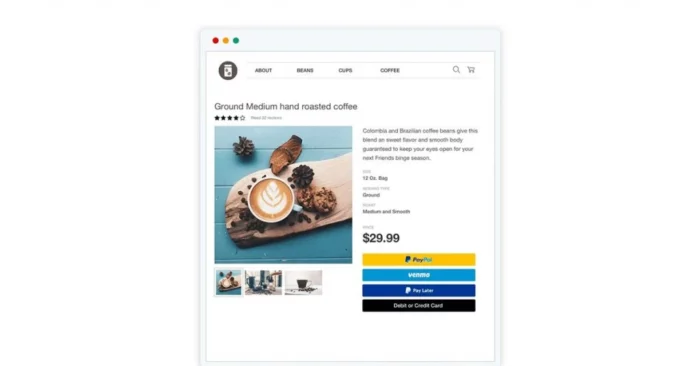

2. PayPal

PayPal is among the most popular and trusted payment gateways for transferring and receiving international payments. It may provide local payment options and accept payments from over 200 markets in over 100 currencies. In addition, you can make customizable invoices, personalized payment URLs, add recurring payment options, and more to ensure seamless payment processes.

Features

- No setup/maintenance fees.

- Both debit and credit card payments are accepted.

- There are shopping cart integrations.

- 24/7 transaction monitoring, vendor protection, and fraud prevention.

- Operates on web browsers.

- Offers mobile app.

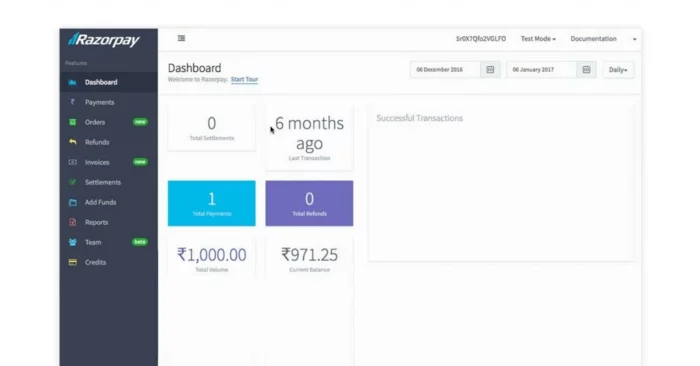

3. Razorpay International Payments

Razorpay gateway accepts all major international cards and lets customers choose from 92 currencies. Well, you can automate recurring transactions for various modes of payment or share links via various communication channels for fast payments. In addition, it gives options on its dashboard to make promotional offers for different customer segments.

Features

- Conversion of currency in real-time.

- INR option for settlements.

- Integrated PayPal support.

- Analytical insights regarding payments, refunds, etc.

- PCI DSS Level 1 complaint.

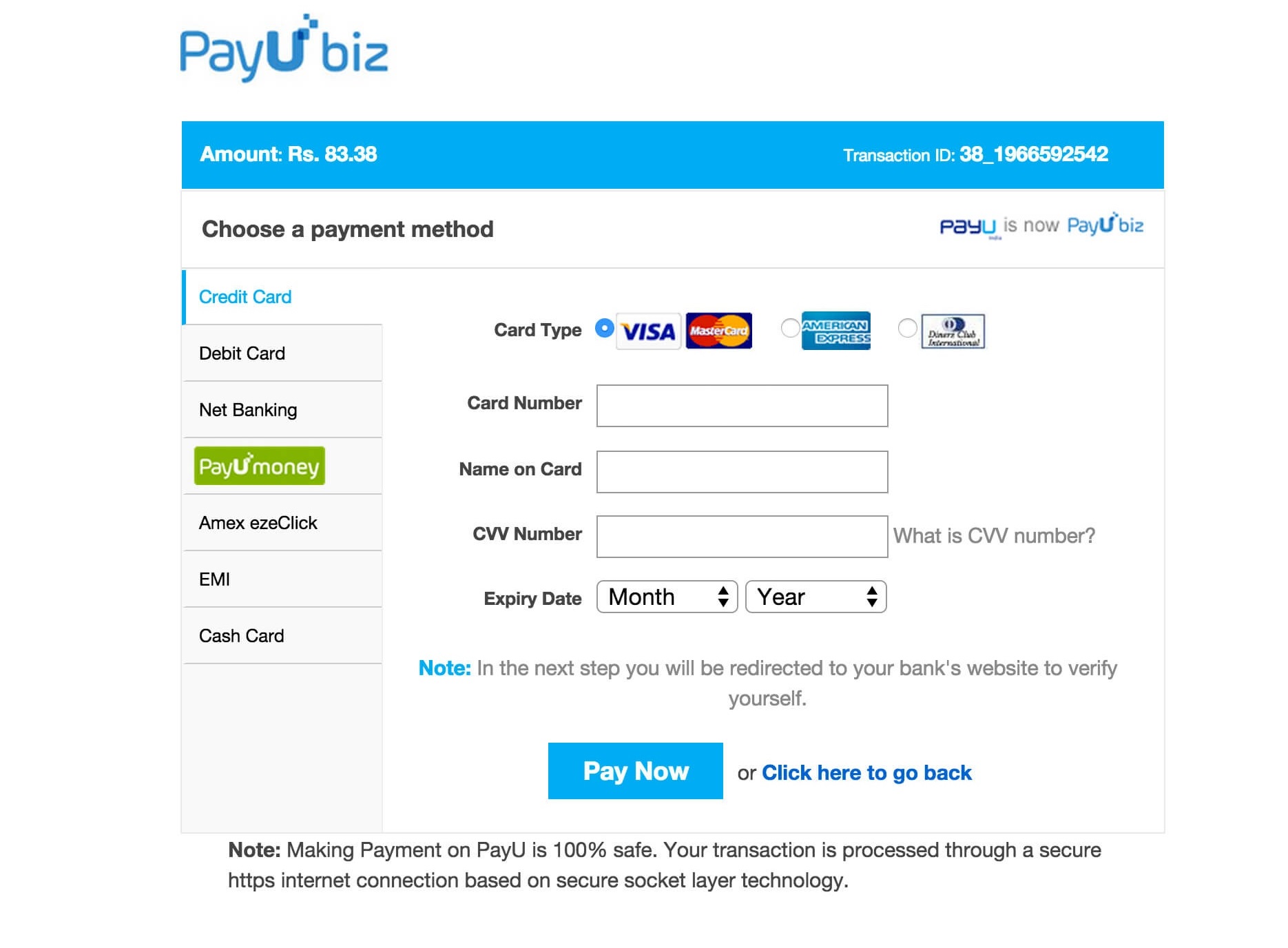

4. PayUbiz

PayUbiz payment gateway solution allows credit cards, debit cards, and net banking choices in over 50 banks for international payments. You can perform real-time transaction analysis based on a variety of parameters. In addition, it provides specialized reports for a thorough comprehension of conversion rates.

Features

- Easy setup.

- One tap payment.

- Settlement in 125+ currencies.

- Has Android & iOS SDKs.

- Global bank partnerships to mitigate Forex risk.

- Support for purchasing cart & e-commerce modules.

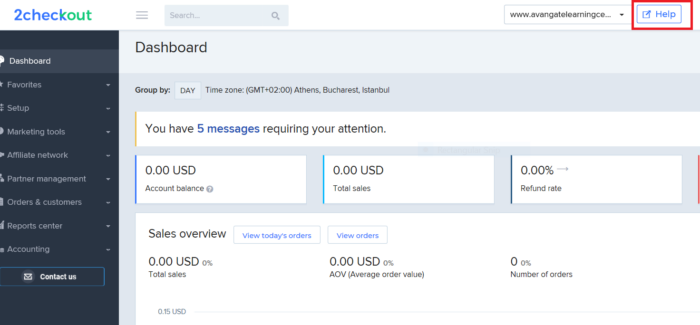

5. 2Checkout

2Checkout platform enables merchants to sell in 200 countries through over 45 payment methods, including standard credit or debit cards, online wallets, and regional payment. It enables integration with a local payment processor to activate domestic cards. You may create subscription renewal links for customers. This international payment gateway informs customers about failed renewals via email to reduce the possibility of lost revenue due to declined payments.

Features

- One hundred billing/display currencies.

- Security & fraud protection.

- Global tax & regulatory conformance (2Monetize plan).

- Reporting & analytics.

- Integration with 120+ vehicles.

- Supports 30+ languages.

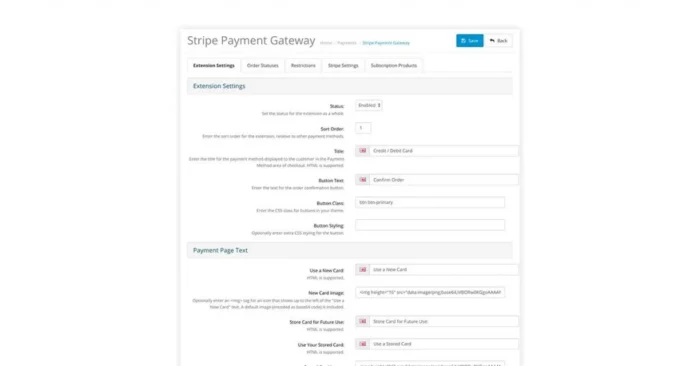

6. Stripe

The Stripe gateway platform allows merchants to accept credit cards, debit cards, and other globally used payment methods across online channels like marketplaces and e-commerce stores. It offers customizable elements to help you design your payment form that can be shared via a link. In addition, it uses machine learning (ML) to recapture declines and decrease unsuccessful payment rates through smart retries.

Features

- Support for 135+ currencies.

- Localized payment options with Bitcoin, ACH transfers, etc.

- Customizable invoices for recurring or one-time payments.

- Android & iOS SDKs.

- Financial reporting & consolidated reports.

- Integrations with PCI compliance.

7. CCAvenue

CCAvenue is a prominent international payment gateway to collect payments in 27 foreign currencies. You can integrate purchasing carts and customize the payments page to complement your site. With these marketing tools, you can create discounts and conduct promotional campaigns for customers. If you don’t have a website, you can use it to construct a customizable storefront.

Features

- Multiple payment options (58+ Net Banking, 15 Bank EMI, 97+ Debit Cards, 13 Prepaid Instruments, 6 Credit Cards).

- PCI compliance.

- Smart routing to the top performing gateway.

- Retry choice to reduce the number of payment failures.

8. Instamojo International Payment

Instamojo International Payment Gateway offers the option to accept online payments through more than 100 modes, including UPI, bank transfer, and NEFT. In addition, you may send bulk requests to customers via SMS/email to receive payments more quickly. Furthermore, with the clever pages feature and in-built payments, you get customizable themes and other features to generate leads.

Features

- Smart payment connections with expiry dates.

- Embed pay icon on blogs/webpages.

- 3 Faster payout options: Instant, same day, next day.

- PCI-DSS validated payments.

- APIs & modules for simple integration.

9. EBS Payment Gateway

EBS Payment Gateway supports over one hundred payment options, including credit cards, wallets, debit cards, net banking, and more. You can generate personalized invoices and send customers payment links via SMS or email. It employs pre-screening algorithms to ensure the legitimacy of transactions. You can assess your business’s performance and increase profits with real-time reports.

Features

- Support for eleven main currencies.

- Shopping cart extensions.

- Android & iOS SDK.

- PCI DSS 3.0 compliant.

- Payment page customization in 7 different languages.

10. PayU International Payment

PayU Payments (prior PayUmoney) assists merchants in accepting international payments in over one hundred currencies on their app or website. There are multiple UI options for checkout pages that you can use. In addition, you can set up online stores and share payment links on SMS and various social media platforms for accepting payments.

Features

- Simple sign-up.

- PCI DSS compliant.

- Mobile & desktop optimization.

- Intelligent recommendations for the most popular/successful payment method.

- 24*7 integration support.

FAQs:

Which Is The Best International Payment Gateway?

Stripe, PayU, Instamojo, and PayPal are some of the finest international payment gateway options. What fits you the best will depend on your budget, business size, and features required.

How To Accept International Payments?

You may accept international payments online by integrating international payment gateway services such as CCAvenue and PayU for customers.

The Bottom Line:

Even though there are several international payment gateway providers, a significant portion of the community still needs to be expanded to vendors that support domestic options. A suitable payment gateway in this age of digitalization can help you achieve global business expansion and gain a competitive edge. Therefore, initiate one of the previously mentioned options as soon as feasible.